Peer-to-Peer (P2P) Alternative Payment Services

SIMPLE . BETTER. CHEAPER . FASTER .

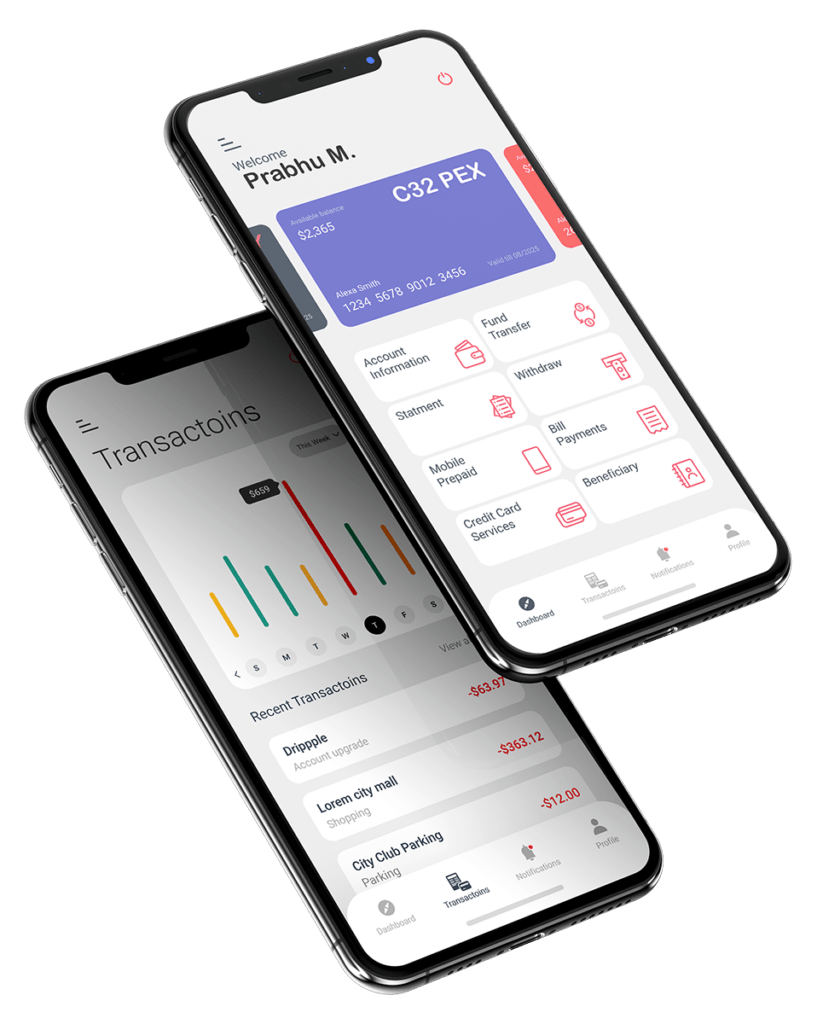

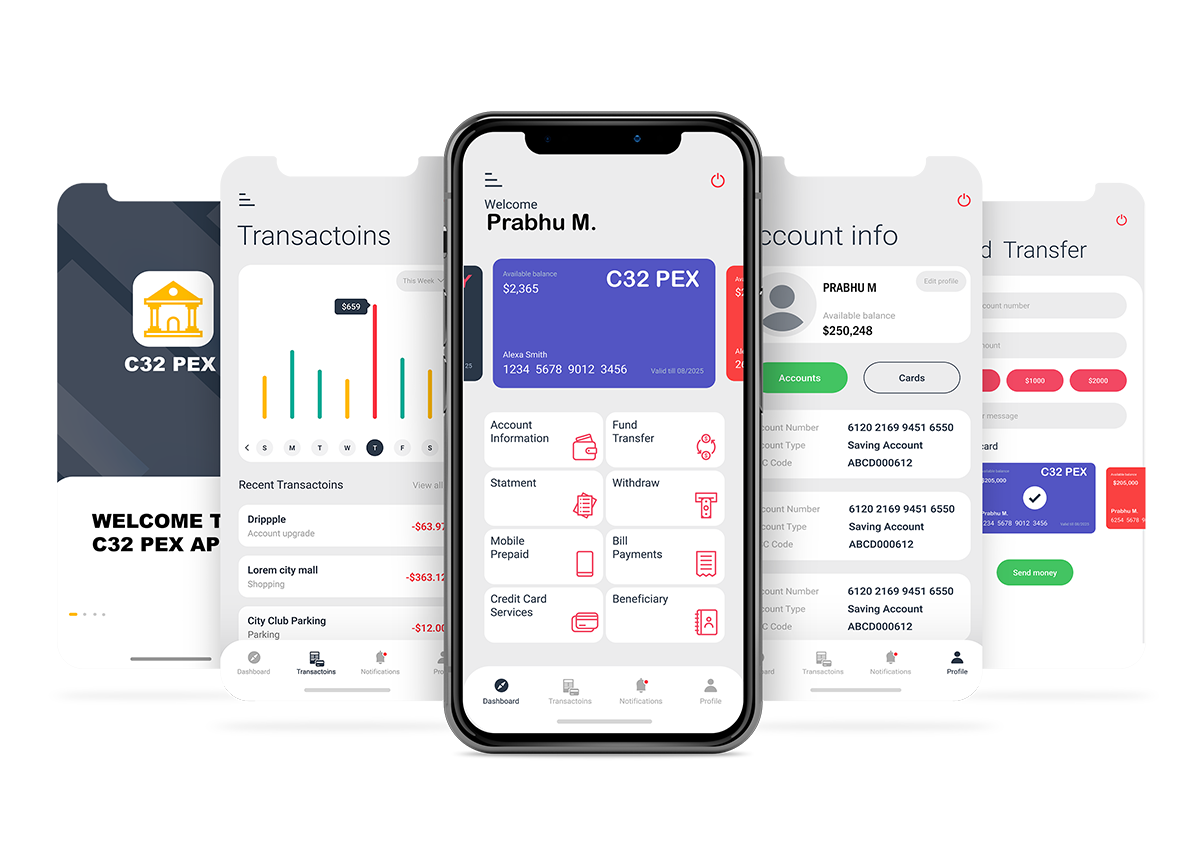

C32 contactless mobile wallet and fuze payment device.

OUR SECTOR

Fintech Payments , Mobile Money & Mobile Africa's 1st Neo Hyper Mobile bank.; Blockchain. .

MARKET SIZE

$ 1 Trillion global mobile money market by 2023, Market size today $ 690.1 billion. .

WE SERVE

SME business , Students , Expats , Salaried Individuals and smartphone users

AFRICA’S 1ST MOBILE ONLY NEO HYPER BANK

We aim to deliver friendly, fair, open, better & hyper personalized mobile banking experience.

C32 open digital payment wallet and mobile banking app offer uniquely integrated fiat and crypto capabilities in a feature – rich, convenient and competitively priced environment.

Making economy work for more people is our key focus.

Neo Hyper Mobile Bank

Our mission is to serve the unbanked and underbanked customers and communities with unique wealth creation opportunities and tools;

Powering Financial Products For The Banked & Unbanked

To enable faster & real time payments.

To lower financial inclusion barrier.

To offer liquidity and better wealth creation opportunity to digital asset owners.

Our banking products will help unbanked and underbanked population economically successful; and fundamentally change the way we Perceive, talk about and handle our money.

C32PEX® Open digital payment wallet and Mobile banking app with current account IBAN Powered by regional partner bank.

It’s a new type of bank account

For SME Business , Students , Expats And Salaried

Beside our impact Mobile Only Neo Hyper Mobile Bank initiative , at C32pex we offer Bank in a Box

Multi-channel acquiring and processing

Cardholder Services

What is C32? Why Call Ourselves C32?

It’s inspired from a Compass rose 32.

Navigation tool that has been used since the 14th century. a circle divided into 32 points or 360° numbered clockwise from true or magnetic north, printed on a chart or the like as a means of determining the course of a vessel or aircraft.

C32®️ open payment and mobile banking app – aspires to be financial prosperity compass for the digital native , unbanked and underbanked. C32®️ 21st century’s Innovative . Alternative . Modern . navigation tool that empower consumers determine the course of their financial wellbeing and success.

C32®️ we offer smart tools to manage money and personal finance smartly .

C32®️ Tools: with confidence and at ease consumers may navigate safely towards their desired financial goal, discover new wealth creation opportunities and experience the new world of finance and banking products /services anywhere , anytime.

Why we do what we do

We believe MSME /SME business , salaried expatriates , and students community deserve better banking service and experience. At present , the community is poorly served by traditional banking service providers.

So many highly educated people are living pay check to pay check, expatriates sending money back home is inconvenient , time consuming and costly ; SME entrepreneur’s and start-up’s do not have easy access to project and business financing .

Reason why, We choose to build C32 “ Neo Hyper Mobile Bank* “ from the ground up . In order to serve the community with better banking service they deserve , close the widening economic inequality , and create easy access bank accounts and formal financial services for global unbanked.

413 million people in sub-Saharan Africa live on less than $1.90 a day. In least developed and landlocked developing countries, at least one quarter of workers live in extreme poverty despite having a job. Employed young people (between 15 and 24 years of age) are more likely to be living in poverty, with a working poverty rate that is double that of adult workers. Source: SDG Indicators (un.org)

COMMUNITY

Giving the gift of financial freedom & economic success to less economically privileged individuals.

We’ll be offering free C32 Impact mobile bank account and connected smart phone device to people in sub-Saharan Africa live on less than $2 a day.

Making economy work for more people is our key focus.

With the help of Global rainbow foundation – RISE global community network , social enterprises , NGO’s , impact business incubators , referral network we’ll reach the impact mobile bank account customers /Beneficiaries.

C32 impact mobile bank account offer easy Micro credit access, micro insurance; and Deliver a Friendly, Fair, Open, and Better banking & payments experience for all.

All C32 impact mobile bank account customers be able to

ACCESS: Business franchise opportunities , part time jobs , MSME project /business finance, weekly working capital, low-interest rate productive p2p community loans , low fee or free global remittance solution and formal financial services .

C32 GIVING BACK: % of c32 daily transactions revenue to impact community lending fund pool (ICLFP).

Our blockchain fund & impact P2P lenders contribute in to impact lending fund pool (ICLFP).

The purpose of ICLFP is to offer low interest rate or interest-free , collateral free MSME productive lending; and gifting the community with financial freedom and economic success.